3. Parish operations

Transaction and investment accounts

Establishing accounts

All parish transaction and investment accounts are expected to be held with the Catholic Development Fund (CDF) (through NAB) unless there is good reason for not doing so. All accounts, whether held with the CDF or external banks, must be incorporated into a parish’s accounting system so that a complete consolidated record of income, expenditure and total funds available is maintained.

There are limited circumstances where it is not possible for a parish to maintain all accounts with the CDF. For example, a parish in receipt of a government grant may have a contractual obligation to hold the funds with an authorised deposit-taking institution (ADI). In this instance, the parish would be required to open an external bank account. The CDF has arrangements available through Australia Post and other NAB solutions to cater for cash-handling and access requirements. The lack of a local NAB branch would not be sufficient reason for opening a non-CDF account.

Each parish with a priest receiving the stipend shall have at least two transactional accounts as follows:

- [Name of Parish] Church Account

- [Name of Parish] Presbytery Account.

Priests responsible for their own vehicles (those who are not members of the Priests’ Car Pool) may access the benefit of the prescribed car capital allowance via a parish account established for this purpose. The allowance may accumulate until the priest purchases a new vehicle. Funds held in the Car Capital Allowance Account must be directed to the vehicle supplier by the parish for the exempt benefit rules to apply (see ‘Exempt fringe benefits protocol’ in chapter 3). Alternatively, payment of the car capital allowance to a priest directly is an option but is subject to the PAYG withholding tax obligations.

- [Name of Parish] Priests’ Car Capital Allowance Account [#1, #2 etc for each priest]

Term investment accounts should be maintained for the holding funds surplus to the parish’s immediate operational needs as follows:

- [Name of Parish] Investment Account.

Parishes with more than one Mass centre are to make arrangements with each Mass centre to deposit all income into the parish Church Account. Likewise, expenditure for each Mass centre will be made from the same parish Church Account. The parish’s accounting package should be used to keep records of the income and costs attributable to Mass centres in preference to establishing and maintaining multiple Church accounts.

Accounts for the following activities may be kept separately from the Church Account, but parishes are encouraged to keep additional accounts to a minimum:

- bingo, fete and general fundraising

- religious instruction

- social committee or functions

- commercial property rental, church/hall building hire

- commercial operations such as retirement villages, early learning centres.

Account signatories

All parish accounts, except for the Presbytery Account, are to each have a minimum of three signatories, with transactions approved by any two signatories. Presbytery Account transactions may be signed by the parish priest solely. Credit cards require one signatory and must only be used by the authorised card holder.

The parish priest must be listed as a signatory for all parish accounts and is the ‘authorising party’ for any changes to account-signing authorities.

Ordinarily, the parish priest and one other signatory would authorise each payment transaction, whether by cheque or via CDF online. It is recommended that the chairperson and treasurer of the parish finance committee be included as signatories. Parish employees may be included as account signatories.

Signatories should be reviewed and updated annually.

The parish priest is permitted to renew term investments and to authorise redemptions of term investments to the Church Account solely.

It is recommended that signatories be appointed by the parish priest after informing the parish finance committee.

Recording transactions

The Archdiocese strongly recommends Xero as the preferred parish accounting software.

For recording and reporting purposes, income and expenditure through all parish operating and investment accounts (excluding Presbytery Account income and expenditure) must be fully recorded and reported in the parish's accounting package. This is to ensure that all financial resources available to the parish are clearly identified and reported on a consolidated basis, and that proper governance is applied. To be clear, any activity conducted under the authority of the parish priest resulting in income being earned or expenditure incurred by the parish (excluding Presbytery Account transactions) is to be included in a consolidated financial report.

The Archdiocese has published a Standard chart of accounts to be used by all parishes.

Recording GST

While the detailed income and expenditure of the Presbytery Account is not included in the parish’s financial reports, the goods and services tax (GST) incurred on presbytery expenditures is generally eligible to be included in the parish’s business activity statement (BAS). Note that GST incurred on a priest’s personal expenditures relating to entertainment, recreation, holidays and meals is not eligible to be claimed as a GST input tax credit. GST incurred on pastoral-related expenditures, vehicle running costs, subscriptions, formation and training, and similar costs is eligible for claiming as an input tax credit.

The following steps are recommended for recording GST claims on presbytery expenses (for Xero users):

The GST recoverable from presbytery-related expenditure should be recorded in the parish’s balance sheet via a journal entry recognising the amount receivable from the Australian Taxation Office (ATO) and the corresponding amount payable back to the Presbytery Account. The journal entry in this scenario is:

For Xero users

Dr GST Paid (820)

Cr Presbytery Clearing Account (5030)

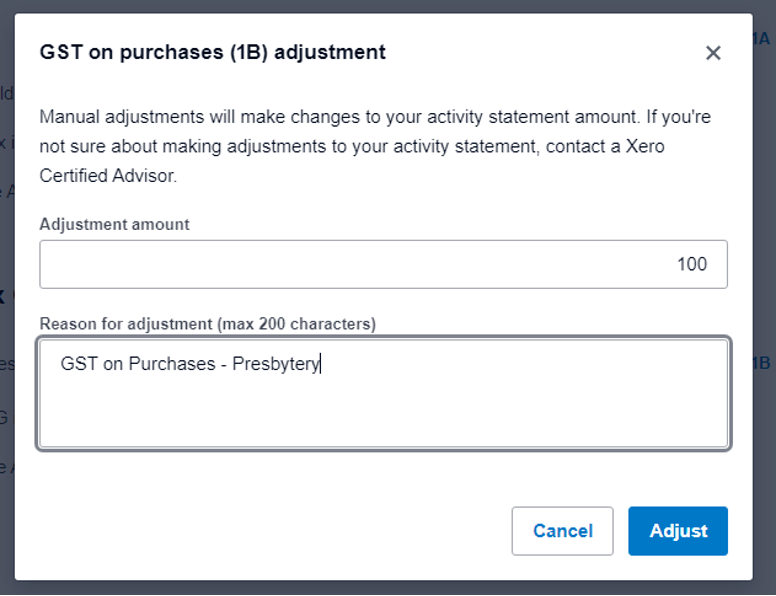

Adjust BAS item 1B by making a manual GST adjustment in Xero as per the example below. This will increase the GST refund claim on the BAS.

If you’re not sure about making adjustments to your activity statement, please speak with your parish accountant or contact the Parish Support Officers at the Archdiocese.

- When the parish’s GST refund is received from the ATO, PACS users allocate the refund to the GST-paid account (4301); Xero users allocate the refund to the GST-paid account (820).

- Transfer the $100 GST presbytery portion from the Church Account to the Presbytery Account and allocate the payment to the presbytery clearing account (5030).

- Note that the same tax invoice–retention requirements that apply to claiming GST by the parish also apply to substantiating GST claimed on presbytery expenses. The parish priest should ensure these documents are retained and made available to the parish in the event of an ATO GST audit.

Church account income and expenses

The Archdiocese recommends that a modified accruals basis of accounting be adopted with the following:

- Capital expenditure over $1,000 is recorded on the balance sheet and depreciated over its useful life (ATO depreciation rates may be adopted).

- Minor capital expenses under $1,000 is allocated to an operating expense account (e.g. 2360 ADM).

- Real property and building purchases are capitalised on the balance sheet.

- Borrowings are recorded as a liability on the balance sheet, so that the interest is recorded as an operating expense but not the principal repayment component.

While not required to do so by the Archdiocese, parishes may choose to record expenditure and income on an accruals basis and maintain creditor and debtor ledgers in Xero. Care should be taken if recording creditors and debtors, to ensure the accounting basis aligns with the GST-registration status of the parish (i.e. cash or accruals).

Income

All parish income from thanksgiving collections (‘second collections’), Archdiocesan-approved special collections, fundraising and other sources as listed in the parish annual financial statement are to be deposited into the Church Account.

Expenditure

The following parish expenses are paid from the Church Account:

- gas, electricity, telephone, internet and other utilities for both church and presbytery buildings

- repairs and maintenance for both church and presbytery buildings

- insurance premiums, municipal charges and water charges for both church and presbytery buildings and properties

- motor vehicle expense reimbursements for priests up to the maximum amount specified (refer to Active clergy remuneration schedule)

- supply fees during a priest’s four weeks of annual holidays

- supply fees when a priest is on approved sick leave

- supply fees when a priest on special duties living in the presbytery is on annual holidays and thus is unable to perform weekend supplies

- Archdiocesan Quota Levy

- all other liturgical, special-collection remittances, and pastoral and administrative expenses.

Capital expenditure versus operating expenditure

Expenditure under $1,000 for the purchase or upgrade of property, buildings, vehicles, plant and equipment, and furniture and fittings is classified as minor capital expenditure and can be coded to the operating expense 2360 ADM or 2360 PAS. Capital expenditure over $1,000 on vehicles, machinery, office furniture and equipment should be recorded in the account range 4600–4640 according to the category of assets acquired.

Operating expenditure relates to recurring costs such as stipends, wages, insurances, liturgy costs, other pastoral expenses, routine building and maintenance etc.

Presbytery account income and expenses

The money paid into the Presbytery Account is the property of the parish and not the personal income of the parish priest. Monies held in the presbytery account are held for the benefit of the parish priest and assistant priest(s).

Parishioners should be informed and educated that the ‘first collection’, the presbytery collection, is exclusively for:

- the support of the priests of the parish

- the support and subsidy of a great number of priests throughout the Archdiocese

- the support of the Archbishop

- the support of pastores emeriti.

See ‘Religious order–administered parishes’ below for further details on what happens when the pastoral care of a parish is assigned to a religious order and one of their clergy is appointed parish priest.

Income from presbytery collections (first collections)

The following receipts must be paid into the Presbytery Account:

- proceeds of a specific collection (the presbytery collection) at Saturday Vigil, Sunday Mass and Christmas Masses (no collections are taken up on other Holy Days of Obligation)

- Christmas and Easter dues

- stole fees for baptisms, marriages, funeral offerings

- parochial chaplaincy fees (for hospitals, convents etc.)

The traditional contributions of Christmas and Easter dues and stole fees should be maintained. The amount received from dues, stole fees and funeral offerings is essential for the adequate remuneration of all priests throughout the Archdiocese. Most importantly, parishes that have a history of claiming on the Priests’ Remuneration Fund should not abolish dues or stole fees and funeral offerings.

Presbytery expenditure

General payments from presbytery account

Levies and cathedraticum are calculated on the total gross receipts paid into the Presbytery Account, as specified above under ‘Income from presbytery collections (first collections)’, excluding Mass offerings. The following contributions are to be deducted on a quarterly basis:

- cathedraticum of 5% for the Archbishop to the Archdiocese Finance Office

- a contribution of 12.5% to the Priests’ Remuneration Fund

- a contribution of 12.5% to the Priests Retirement Foundation.

The following expenses are paid from the Presbytery Account:

- normal household expenses including food, hospitality and housekeeper salary

- diocesan car capital allowance as per the Active clergy remuneration schedule

- regular supply fees to augment Sunday Masses provided by the parish priest as per the Schedule of stipends—supply priests.

After all these payments have been allocated, the Archdiocesan minimum living allowance is paid from the Presbytery Account to the priest(s) of the parish, as either cash or exempt benefits.

PAYG withholding tax

Priests are to provide the parish with a tax file number (TFN) declaration, which will determine the rate of tax (if any) to be applied to personal stipend payments. If applicable, priests must apply to the ATO for a PAYG withholding variation if they wish for a lower rate of withholding tax to apply.

Where a TFN is not provided to the parish, PAYG withholding tax is required to be deducted from the personal stipend component at the top marginal tax rate plus Medicare, and remitted to the ATO.

In general, payments to parish and assistant priests from the Presbytery Account should be made quarterly, no later than 14 days after the end of the quarter. Payments are required to be reported to the ATO under Single Touch Payroll requirements. PAYG withholding tax may apply. It is recommended that clergy use the Archdiocesan Parish Payroll Service for stipend-processing requirements to ensure tax and reporting obligations are met.

Exempt fringe benefits protocol

The only component of remuneration that is considered as assessable income for taxation purposes is the amount of stipend paid directly to a priest.

All other components (including expenses or benefits paid for directly using funds from the Presbytery Account) are regarded as exempt benefits by the ATO and are not subject to either income tax or fringe benefits tax (FBT).

Subject to the exceptions noted for entertainment and other personal-related expenditures noted above under ‘Recording transactions’, GST paid on benefits provided to priests through the Presbytery Account should be claimed by the parishes when lodging the BAS.

Priests and parishes are reminded of the ‘Exempt benefits protocol for active priests’, originally published in May 2002 and updated below:

Exempt benefits protocol for active priests

General background

- A fringe benefit is a ‘benefit’ provided to an employee (or an associate of the employee) by the employer (or an associate of the employer), in respect of the employment of the employee.

- Benefits provided by religious institutions to priests are exempt benefits where provided in relation to the exercise of pastoral duties or other duties closely related to the practice, study, teaching or propagation of religious beliefs.

- Legislative changes introduced in 2002 mean that priests, while not employees, are required to comply with PAYG withholding taxation purposes.

- A benefit includes provision of any right (including real or personal property), privilege, service or facility.

- A benefit provided in respect of employment effectively means a benefit provided to someone because he or she is an employee.

- Exempt benefits are exempt from the application of FBT. While commonly referred to as exempt fringe benefits, they are more correctly described as exempt benefits.

Types of exempt benefits

The following exempt benefits are available to priests. They are paid from the Presbytery Account and their provision is excluded from the living allowance calculation:

- board and lodgings

- hospitality (including food and sustenance)

- health insurance

- motor vehicle provision.

From 1 July 2002, the following additional exempt benefits may be taken from the Presbytery Account. They are to be included in the living allowance calculation and are part of the priest's inventory (as opposed to the parish inventory):

Benefit type 1, tools of trade : annual retreats, briefcases and [personal electronic devices]. This is distinct from those items purchased by the parish from the Church Account, which remain the property of the parish

Benefit type 2, knowledge pursuit : subscriptions to professional journals, relevant pay TV subscriptions and equipment, library, periodicals, professional memberships, self-education expenses

Benefit type 3, travel and accommodation :

- costs associated with the priest’s four weeks’ annual leave

- car accessories and types other than the basis provision.

Amendments to the above list will be notified from time to time. Outside of this list, no other benefits are to be taken from the Presbytery or the Church accounts.

Monies retained in the Presbytery Account

Money retained in the Presbytery Account for these purposes is vested on behalf of the priest for the purpose of building a balance and meeting expenditure. These vesting accounts must be reduced to zero either at 1 March or by 30 June each year, save that the Mass offering contributions may remain vested for up to three years.

Minimum entitlements to be taken

It is recommended that at least the minimum PRF living allowance, as adjusted from time to time, be taken as either cash or benefit type 1 or 2 in any one FBT year (1 April to 31 March). In all cases, no less than 50% of the minimum living allowance is to be taken as cash or benefits 1 or 2 in any one FBT year.

For married clergy, these benefits can be provided to the spouse and children. The education of their children may be added to the list of type 2 benefits.

Priests’ Remuneration Fund support for active clergy

Refer to ‘Priests’ Remuneration Fund’ in chapter 9 for details of the PRF. This fund exists to ensure that priests receive equitable and sufficient income and the necessities of life.

Where the Presbytery Account is not able to provide the minimum living allowance component, the priest makes a claim on the PRF for subsidised remuneration. The amount received from the PRF should be paid to, or set aside for, the parish priest or assistant priest as soon as possible after it is received in the Presbytery Account.

Religious order–administered parishes

The provisions contained in this Handbook relating to PFC and parish priest responsibilities apply equally to parishes where a member of a religious order is appointed parish priest. There are, however, a few differences to note in relation to the first or ‘presbytery’ collection:

The presbytery collection should be deposited to the parish Presbytery Account in the normal manner and funds then transferred to an account in the name of the religious order, which is then subject to the order’s own administrative arrangements. It is expected that monies will still be applied to meet expenses normally covered by the Presbytery Account as noted above under ‘Presbytery expenditure’.

Religious order–administered parishes are required to pay the cathedraticum from the presbytery collection but do not pay levies for the Priests’ Remuneration Fund or the Priests Retirement Foundation. The order, not the PRF or Foundation, is responsible for supporting order priests, both those clergy with active appointments and those without.

In most cases, the terms of the appointment of a religious order priest to a parish will be contained in an agreement between the Archbishop and the provincial or superior of the order concerned. The Archdiocese will advise the parish if there are any particular administrative requirements that differ from these standard provisions.

Administration for partnered, mission and amalgamated parishes

Take the Way of the Gospel (TWG) seeks to envision ways of adapting the Church in Melbourne in the future such that:

- the mission of the Gospel is at the heart of life, worship and outreach

- local faith communities are arranged to allow for them to flourish

- faith communities are effectively resourced—spiritually, ministerially and materially.

Presently there are several models of collaboration for multiple parishes, and these are listed below, together with a brief description of the governance and administrative structure:

Partnered or ‘twinned’ parishes

- A single priest is appointed as parish priest of each parish.

- Assistant priests (where appointed) share in the ministry, supervised by the parish priest.

- Parishes retain individual identities.

- Parishes maintain separate parish finance committees.

- Parishes maintain separate parish bank accounts.

Mission parishes overseen by priests in solidum with a moderator appointed (who assumes the juridic responsibilities under canon 517, §1):

- Priests in solidum are equally responsible for the pastoral responsibilities of the parishes.

- Parishes retain individual identities.

- Parishes maintain separate parish finance committees, although they can meet concurrently.

- Parishes maintain separate parish bank accounts.

Newly amalgamated parishes (where two or more parishes combine to form a new single parish):

- A single priest is appointed as parish priest of the sole continuing parish entity.

- Assistant priests (where appointed) share in the ministry, supervised by the parish priest.

- Parish finance committees are combined into a single committee.

- Parish bank accounts and other reserves are consolidated into accounts under the ownership of the new continuing parish entity.

The Archdiocese and the TWG Advisory and Reference Group are collaborating on the implementation of the Take the Way of the Gospel Strategy, particularly as it applies to parishes. Formal guidance on the administration requirements for parishes are under development and will be published at a later date.

Change-over of parish priests

Before the proposed changeover date, the leaving parish priest must meet with the incoming parish priest to share information about the parish and inform the incoming parish priest of all that has happened in the tenure of the leaving parish priest, to ensure the incoming parish priest has the necessary knowledge and understanding of the parish.

Before leaving the parish, the parish priest is required to attend to each item listed in the Changeover of Parish Priest Checklist to ensure a smooth changeover with the incoming parish priest.

The following administrative arrangements have been advised by the Vicar General’s Office:

ACNC—notification of change of parish priest or administrator

When a parish priest or administrator commences a new parish appointment, it is necessary to notify the Australian Charities and Not-for-Profits Commission (ACNC) of the appointment.

This can be done by a parish employee (under the authority of the parish priest) by logging into the parish’s unique portal on the ACNC website. The information required by the ACNC will include the priest or administrator’s full name, date of birth, residential address, position held and the date on which the appointment commences.

This information must be provided to the ACNC within 28 days of the appointment if the parish’s income exceeds $500,000 per annum, or otherwise within 60 days of the appointment.

ATO/ABR—notification of change of parish priest or administrator

Upon a change of parish priest, the Parish Support Office will coordinate with the Vicar General’s Office to notify the ATO of the parish’s authorised contact person. This should be done within 28 days of being appointed parish priest.

Parishes should maintain up-to-date credentials on the ATO portal and access to the ATO’s Authorisation Manager portal at www.authorisationmanager.gov.au. Address, email and bank account details can be updated through the portal.

For parishes that do not have access to the ATO portal, the record can be updated by completing the Change of Registration Details form.

Completing Change of Registration Details form to change public officer details

Section A: Complete parts 1, 2 (branch number if applicable), 3 and 4. In the unlikely event that a parish has a GST or PAYG branch, leave blank.

Section B: Select No.

Section C: Select No.

Section D: Select No .

Section C: It is a good idea for the parish secretary to add him-or herself as a contact person for the parish. Select Yes if you want to be a contact person.

Section F: Select Yes:

- Item 16: Select Yes and Public Officer and complete all the fields.

- Item 17: Select No.

- Item 18: The parish may choose to add an additional associate in the role of officer bearer of a club/association. If that is the case, select Yes; otherwise, select No.

Section G: Select No.

Section H: The nominated public officer’s details are included here. The position held is Public Officer. The nominated public officer needs to sign this document.

Lodging Change of Registration Details form

The Change of Registration form needs to be lodged along with:

- the Nomination as Principal authority and Public Officer form. This is completed by the parish priest.

- meeting minutes recording the nomination being accepted by the finance committee. A meeting minutes template can be found here. This must be on parish letterhead.

Certified copies of the minutes and nomination form need to be attached to the change of registration form.

To certify the minutes and nomination form:

take photocopies of the original minutes and nomination form. The parish retains the original minutes and nomination form

have the minutes and nomination form certified by a parish priest who is certified to celebrate marriage. To avoid a conflict of interest, the documents must be certified by a priest from another parish

ensure that the approved certifier certifies that each copy of an original document is true and correct by:

- physically sighting the original document and the copies of the front and back at the same time

- signing and annotating the copy of the document with wording similar to ‘I have sighted the original document and certify this to be a true and correct copy of the original document sighted’

- providing the following details: full name, telephone number, qualification (‘minister of religion certified to celebrate marriage’), registration number if relevant (in this instance, it is not), date of certification.

To lodge the paperwork, make a copy of all the documents for your own records before sending the Change of Registration Details form—along with certified copies of the minutes and nomination form—to:

Australian Taxation Office

PO Box 3373

Penrith NSW 2740

If you have any questions regarding this process, please direct enquiries to parish.finance@cam.org.au, or to Stephen Steward at 0417 718 496, or Colin D’Rosario at 0429 052 374.

Updating the ATO and ABR when there is a change of parish name

As part of an amalgamation process, the parish name will be changed, and this change must be registered with the Australian Taxation Office (ATO) and Australian Business Register (ABR).

The parish priest needs to be registered with the ATO and ABR as the public officer, as he will need to sign the Change of Registration Details form.

If the parish priest is not registered as the public officer, he will need to do so by completing a separate Change of Registration Details form. (See ‘ATO/ABR—notification of change of parish priest or administrator’ in chapter3.)

Alternatively, if the parish has engaged an external tax accountant, the accountant can complete the Change of Registration Details form to notify the ATO and ABR of the change of parish name.

For parishes that do not have access to the ATO portal, the record can be updated by completing the ATO’s Change of Registration Details form.

Completing the Change of Registration Details form to change a parish name

- Section A: Complete parts 1, 2, 3 and 4. (In most cases, part 2 can be left blank as it is unlikely that a parish will have a GST or PAYG branch.)

- Section B: Select Yes and add new parish name.

- Section C: Select No.

- Section D: Select the appropriate response.

- Section C: It might be a good idea to update the contact person for the parish. Select Yes if you want to update the contact person.

- Section F: Select No.

- Section G: Select No.

- Section H: The nominated public officer’s details are included here. The position held is Public Officer.The nominated public officer needs to sign this document.

Lodging change of registration details form

Once completed, the Change of Registration Details form needs to be sent to the ATO along with finance committee minutes recording that the committee has accepted the name change. A meeting minutes template can be found here. The minutes must be on parish letterhead.

A certified copy of the minutes needs to be attached to the Change of Registration Details form.

To certify the minutes:

take photocopies of the original minutes. The parish retains the original minutes

have the minutes certified by a parish priest who is certified to celebrate marriage. To avoid a conflict of interest, the documents must be certified by a priest from another parish

ensure that the approved certifier certifies that each copy of an original document is true and correct by:

physically sighting the original document and the copies of the front and back at the same time

- physically sighting the original document and the copies of the front and back at the same time

- signing and annotating the copy of the document with wording similar to ‘I have sighted the original document and certify this to be a true and correct copy of the original document sighted’

- providing the following details: full name, telephone number, qualification (‘minister of religion certified to celebrate marriage’), registration number if relevant (in this instance, it is not), date of certification.

To lodge the paperwork, make a copy of all the documents for your own records before sending the Change of Registration Details form—along with certified copies of the minutes and nomination form—to:

Australian Taxation Office

PO Box 3373

Penrith NSW 2740

If you have any questions regarding this process, please direct enquiries to parish.finance@cam.org.au, or to Stephen Steward at 0417 718 496 or Colin D’Rosario at 0429 052 374.

Requirements from the Safeguarding Unit

Priests must return a copy of the following documents to the Safeguarding Unit prior to the commencement of their appointment:

- Valid employee Working with Children (WWC) Check (renewed every 5 years)

- National Police Check certificate (renewed every 3 years)

- Annual written acknowledgement of the expectations and responsibilities outlined in the Safeguarding Children and Young People Code of Conduct.

- Successful completion of the Catholic Archdiocese of Melbourne’s Safeguarding Essentials online training module annually.

The Victorian Working with Children (WWC) Check protocol requires that the Safeguarding Unit has copies of all priests’ current WWC Checks on file. Priests need to update their WWC Check profile online to ensure the Archdiocese is listed as one of the organisations for which each priest conducts work. This will ensure that the Safeguarding Unit receives a copy of each priest’s card directly from the Department of Justice.

To list the Archdiocese, log in to the Service Victoria website.

Please add the address:

Catholic Archdiocese of Melbourne

Safeguarding Unit

PO Box 146, East Melbourne VIC 8002

Phone: (03) 9926 5621

Priests moving to Victoria will need to apply for a Victorian WWC Check. Applications can be made through the Service Victoria website.

Please note that no public ministry can be conducted prior to the WWC Check application being lodged.

National Police Check certificate

In addition, it is the policy of the Archdiocese of Melbourne that all clergy obtain a National Police Check certificate on initial and every subsequent appointment and reappointment. Fast and easy applications can be made online through the Australia Post website. Once the certificate has been obtained, please forward a copy to the Safeguarding Unit, who will confirm receipt with the parish priest.

Contact details for the Safeguarding Unit:

Email: safeguardingunit@cam.org.au

PO Box 146, East Melbourne VIC 8002

Phone: (03) 9926 5621

Inventory

The parish priest must securely preserve and archive all records relating to parish assets (c. 1284, §2, 9°). This includes preparing and signing a clear inventory of parish goods (whether immovable property or movable objects, whether precious, of some cultural value or other goods) (c. 1283, 2° and 3°).

The presumption of canon law is that if goods are given to the administrators of any juridical person (such as the parish priest), they are given to the juridical person itself (e.g. the parish) and not to the administrator personally (see c. 1267, §1).

Therefore, any goods that are intended for the parish priest personally must be clearly indicated as such by the donor.

It is presumed that all goods in a church, presbytery, parish office and hall belong to the parish, except those that are specifically listed on a signed inventory of the priest’s goods.

When a parish priest is transferred to a new parish, he may bring with him only those goods that are his personal property. All other goods (furniture, office equipment and supplies, household utensils and so forth) must remain with the parish. A record of the inventory is to be exchanged and updated each time the appointment of a new parish priest occurs.

Arrangements for exemptions to this rule must be made, in writing, to the Executive Director Stewardship.

Please refer to the Parish asset inventory template for guidance as to the information required on a parish goods inventory.

Investments outside of CDF

PFC statute requirements

The Archbishop, as part of his canonical responsibilities, has determined that parishes must seek his approval, through the Executive Director Stewardship’s office, before investments exceeding $100,000 are placed outside of the CDF. Parishes should indicate the total limit required to be approved for amounts invested outside of the CDF. Once a limit is approved, funds may be transferred to and from external investment accounts without reference to further approvals.

Archdiocesan taxes and levies

Authority to raise funds

The Code of Canon Law allows the Archbishop to raise funds for the Archdiocese. He has the right to impose a moderate tax for the needs of the Archdiocese, including:

- a seminary tax

- a tax on public juridic persons

- special collections

- administrative and juridical fees

- extraordinary tax in cases of grave necessity.

Cathedraticum tax

The Archdiocese of Melbourne imposes only one tax on its parishes: the cathedraticum. All parishes should pay this at the rate of 5% of the gross receipts in the presbytery collection. Funds raised from the cathedraticum are provided to support the works of the Archbishop. It is to be paid from the Presbytery Account or the equivalent account for parishes administered by a religious order.

Diocesan Quota Levy

All parishes in the Archdiocese should pay the Quota Levy, which has been established to be the principal source of funding for diocesan agencies and activities that extend beyond the ability of individual parishes to undertake and which are a vital expression of the mission of the Church.

The Quota Levy is overseen by the Diocesan Pastoral and Development Commission (DPDC), which is comprised of clergy from the four regions and the Archdiocese.

The activities funded by the Quota Levy include:

- parish support and subsidies

- Proclaim: The Office for Mission Renewal

- Aboriginal Catholic Ministry Victoria

- Youth, Young Adult and Campus Ministry

- Natural Fertility Services

- Catholic Vocations Office

- Clergy Life and Ministry Office

- DPDC administration and secretariat

- Communications Office

- Melbourne Historical Commission

- Safeguarding Unit

- St Patrick’s Cathedral

- Caritas

- Catholic Social Services.

The Quota Levy is calculated as follows:

| Parish income as per parish annual financial statement YYYY |

|---|

Less parish items deductible:

|

| = Net assessable income |

| + ABS Social Economic Index adjustment |

| = Final income for quota yyyy |

| @DPDC Quota Levy percentage |

| = Quota for YYYY + 1 year |

Parish Mission Development Fund Levy (formerly Land Acquisition Fund Levy)

In 2003, the Archdiocese established the Land Acquisition Fund (LAF) to provide an enduring capital resource that supports the purchase of land to enable the establishment of new parish and educational activities. In 2023, the LAF was renamed the Parish Mission Development Fund (PMDF) to more accurately reflect its purpose. The PMDF no longer supports school-linked acquisitions. All revenue raised through the PMDF is now restricted to the support of parish land acquisitions and new pastoral buildings.

The key co-responsibility philosophy underpinning the PMDF is that some part of the property-sale proceeds realised by established parishes should be used to help the Archdiocese purchase land on which new parish facilities can be built to meet the needs of current and future generations of Catholic families.

To purchase land, the Archdiocese obtains a loan from the CDF. The PMDF provides the funds to pay the interest on the loan taken out by the Archdiocese to buy a particular land holding in advance of the construction of parish facilities.

The PMDF Levy is currently set at 15% and is raised as follows on:

- property sales

- long-term property leases (20 years and over) where a single up-front lease fee is received.

| Property sale price or long-term, up-front lease fee |

|---|

| Less GST (if applicable) |

| Less settlement fees/agent’s commission and marketing fees |

| Less adjustments |

| Net proceeds subject to levy |

| PMDF Levy payable @15% = |

The PMDF is administered by the DPDC.

Applications for relief from the PMDF Levy may be made to the DPDC. Consideration will be given to reducing or waiving the levy where proceeds from property sales or long-term leases will be used exclusively for the purchase of new property or construction of new buildings on existing land.

Insurance

Insurer

All insurances, except for WorkCover Insurance, are to be placed with the provider approved by the Archdiocese. No exceptions exist to this policy.

The preferred WorkCover insurance provider is Gallagher Bassett.

Annual review

Parishes face risks, ranging from the potential effects of fire and other natural events to theft and vandalism. These risks can cause substantial disruptions to activities and can inconvenience parishes and parishioners.

The PFC is to conduct a review of all parish insurance policies on renewal to ensure appropriate and adequate insurance coverage exists.

The PFC’s annual review of policies would typically include buildings and contents insurance, including individual sub-limits for money, burglary and theft, and voluntary workers cover.

It is the responsibility of the PFC to review these policies, consider whether changes to existing arrangements are required and advise the parish priest accordingly. Where a recommendation may be to change the insurance on a building from ‘replacement’ or ‘modified replacement’ to ‘indemnity’ (i.e. essentially to cover the cost of removal in the event of a total loss), the parish priest must seek approval from the Archbishop prior to amending the coverage.

The Archdiocese holds separate master policies for:

- public liability

- professional indemnity

- employment practices

- fidelity

- statutory liability

- directors and officers.

Insurance for committee members

The Archdiocese has taken out a master policy for directors and officers insurance, which provides coverage for parish advisory committee members such as the PFC and Safeguarding Committee. This cover responds to wrongful acts committed (or alleged to have been committed) by members, such as, for example, claims of harassment, discrimination or bullying.

Schedule of required insurances and minimum limits

The following table summarises the insurances required to be held by parishes and recommended minimum limits. Optional insurance cover for clergy personal effects is also available.

Please note that the comments made for each product are only a brief summary of cover and should be read in conjunction with the relevant policy schedules and wordings.

The special risks cover is mainly designed to cover belongings when they are removed from the premises and in transit with a priest or parish member (e.g. in the car, when travelling for work or holiday etc.).

Parishes should direct any queries regarding insurances to their insurance-provider representative.

| Required policies (current cover) | Description of cover | Comments |

|---|---|---|

| PARISH POLICIES | ||

| Composite risks property insurance | Covers buildings and contents on parish sites against loss or damage, as defined in the policy document. Exclusions apply. The policy also extends to provide cover for burglary, money, portable equipment, accidental damage and removal of debris. | The sums insured on buildings and contents should reflect the replacement value of the property or as otherwise agreed.It is recommended that if priests have expensive personal belongings (e.g. medical aids or IT equipment valued at over $2,000), the insurer be advised and the items noted on the policy. |

| WorkCover insurance | The Workplace Injury Rehabilitation and Compensation Act 2013 (Vic.) requires all Victorian employers that pay, or expect to pay, wages in excess of $7,500 per annum to register for WorkCover insurance for their employees. Workcover insurance provides compensation for: replacement of lost income; medical and rehabilitation treatment costs; legal costs; lump sum compensation in the event of a serious injury. A parish is required to register for WorkCover within 60 days of becoming aware that the rateable remuneration for a financial year will or is likely to exceed the exemption limit of $7,500 per annum. | Benefits payable are determined by legislation. Gallagher Bassett should be immediately notified of any injury to an employee giving rise to a potential claim. All paid parish workers must be documented and reported for WorkCover purposes. This can be done only if the individual is identified and recorded on the parish payroll. |

| Fleet motor vehicle | This covers loss and or damage of vehicles caused by an accident or theft and includes third-party property damage. | Cover is for parish-owned vehicles. Responsibility for insuring a clergy vehicle lies with the Priests’ Car Pool for a leased vehicle or with the priest himself for a personal vehicle. |

| Voluntary workers personal accident insurance | This covers accidental injury to volunteers of the parish, including committee members, while engaged in authorised voluntary work, including travelling to and from meetings. | This policy is taken out by parishes. A nil excess applies. The cover does not apply to persons under 10 years or to persons 90 years or older. Compensation is limited to a maximum of $10,000 for persons over 80 years of age. The policy does not cover Medicare gaps or anything that is payable under Medicare. |

| DIOCESAN MASTER POLICY | ||

| Public/products liability insurance | This indemnifies the parish (the Trustees of the Roman Catholic Trusts Corporation for the Diocese of Melbourne) for legal liability to third parties for bodily injury, property damage and advertising liability occurring during the period of insurance and happening in connection with the insured’s business. | The policy is taken as a master policy in the name of the Roman Catholic Trusts Corporation for the Diocese of Melbourne (RCTC), including parishes. Limits apply. |

| Employment practices | This covers the damages and defence costs resulting from an employment practice alleged in a claim. ‘Employment practices’ include wrongful refusal to employ, failure to promote, wrongful demotion, termination, unlawful discrimination and breach of employee privacy. | The policy is structured as a master policy in the name of the RCTC, including parishes. |

| Professional indemnity—general | This covers breach of professional duty by reason of any negligent act, error or omission, including legal liability for libel, slander, loss of documents and any fraudulent, criminal or malicious act of an employee, agent or voluntary worker. | The policy is structured as a master policy in the name of the RCTC, including parishes. |

| Officer’s liability and diocese reimbursement | Covers an officer of the parish for any wrongful acts committed (or alleged to have been committed) by members, such as, for example, claims of harassment, discrimination and bullying. | The policy is structured as a master policy in the name of the RCTC, including parishes. Premium costs are allocated between the Archdiocese, parish and other agencies covered. |

| Fidelity guarantee | This covers parish money, negotiable instruments, goods or other property against theft, embezzlement or misappropriation by employees, apprentices or any authorised voluntary worker engaged in the performance of honorary duties. | The policy is structured as a master policy in the name of the RCTC, including parishes. |

| FREE POLICY COVER | ||

| Personal accident—priests | Cover currently provided by CCI offers a free personal accident policy to all Australian Catholic bishops and diocesan clergy, including seminarians. This policy expires on 30 September 2023. Please refer to the Archdiocese’s Finance Office for further detail regarding future personal accident cover. | Limits apply. |

| OPTIONAL POLICY COVER | ||

| Special risks | This covers the personal effects of priests if they are removed from the presbytery premises or in transit. Effects include, for example, watches, sacred vessels, vestments, photographic and audio visual equipment, computers, sporting equipment, and mobile phone and medical equipment. | An insured sum limit applies to the policy and per individual item. Documentation is required evidencing proof of ownership. |

Parish reporting

Purpose

Canon 1287 requires that parish priests render accounts to the faithful concerning the goods that have been given to the church. Accountability has to be accurate, timely, prepared to appropriate accounting standards and proportionate to the sums involved. This section provides samples of minimum reporting formats to PFCs and parishioners.

The Archdiocese’s preferred accounting platform is Xero, accessed through PACEM for reasons of established integrations, efficiency of administration, and ready access for both parish and Archdiocesan users. Consistent adoption of the preferred Xero platform across parishes will avoid the need to maintain individual local expertise to support the accounting platform.

Reporting to the PFC

PFCs meet on a regular basis and at a minimum quarterly. Accurate and timely reports are to be made available at each meeting.

The type of report presented will be proportionate to the sums involved, but as a minimum, it should include:

- a full income and expenditure statement. Prior-year and actual versus budget comparisons are also recommended

- a balance sheet summary of major assets and liabilities

- details of expenditures above prescribed limits

- any expenditure or act of extraordinary administration requiring approval.

Depending on local circumstances, other reports on property management, sacrificial giving and other finance matters may also be required.

Reporting to the Archdiocese

Canon 1287 states, ‘Both clerical and lay administrators of any ecclesiastical goods are bound by their office to present an annual report to the [Archbishop] who is to present it to the [Arch]diocesan Finance Council.’ In the Melbourne Archdiocese, parishes are required to present a copy of their December year-end accounts by 31 March following each year. This may be accomplished by confirming finalisation of accounting requirements and authorising access to the financial reports available in Xero. Alternatively, parishes should provide the financial report in the prescribed format shown in Template—financial reports.

Reporting to parishioners

Canon 1287, §2 goes onto state, ‘According to the norms to be determined by particular law, [parish priests] are to render an account to the faithful concerning the goods offered by the faithful to the Church.’ The spirit of the canon calls for accountability of stewardship. It is recommended that a ‘condensed’ version of the full income and expenditure presented to the PFC be submitted to parishioners on an annual basis. This should be presented to parishioners in both oral and written form by 31 March each year.

This assists parishioners to become more aware of their responsibility to support their priest(s) and parish.

Safeguarding reporting

The parish priest, as head of entity, in collaboration with the safeguarding committee, is responsible for:

- monitoring ongoing compliance with the Archdiocesan Safeguarding Children and Young People Framework, which encompasses the requirements of the Victorian Child Safe Standards

- preparing a summary of the parish’s compliance with the requirements of the Safeguarding Children and Young People Framework on an annual basis (through the Safeguarding Self-Assessment Tool) and presenting it to the Archdiocese’s Safeguarding Unit.

Parish registers

Parish ecclesiastical (sacramental) registers

The faithful have a right to expect accurate and well-preserved sacramental records. Canon 486, §1 states, ‘All documents concerning the diocese or parishes must be kept with the greatest of care.’ This requires preservation from damage, deterioration, theft, vandalism and fire or water damage. A fireproof cabinet is prudent.

The Archdiocese has prepared Pastoral guidelines for the maintenance of parish registers.

Working with Children (WWC) Check register

All clergy, employees and volunteers over the age of 18 are required to maintain a current WWC Check throughout their involvement in parishes, agencies and entities.

Archdiocesan parishes, agencies and entities must maintain a register of all WWC Checks and ensure that WWC Checks for clergy, employees and volunteers are appropriate to their situation (e.g. volunteer or paid employment), current and linked to the parish, agency or entity (i.e. the person has registered their involvement with the parish).

Further information on the Safeguarding Unit WWC Check register requirements can be found in the Working with Children check protocol.

Parish sporting clubs and hosted associations

Background

Many parishes have a longstanding tradition of providing tennis courts and other sporting facilities, either for parishioners' direct use or through a separate club established for the purpose of promoting tennis or participation in sporting competitions. Where separate clubs are established, whether incorporated or not, they conduct their activities on parish-owned property. These arrangements, often informally documented, require parishes to establish proper governance procedures to ensure their interests in the property are protected and the risks to the parish as landowner are properly managed.

These administrative provisions apply equally to any externally constituted organisation conducting regular activities through the use of, and hosted on, parish property.

Governance requirements

It is recommended that either the PFC itself or a committee of management (COM) formed via a PFC sub-committee deals with the day-to-day management of parish facilities and assists the parish priest in his administration of the parish asset(s).

The COM should consist of a minimum three members and must meet at least once per annum. The COM is required to obtain the written consent of the parish priest for any changes to the terms of the arrangements contained in this section to take effect.

The COM should not allow third parties to use the facilities, or permit the club to ‘sub-let’ a facility to another party, without the prior written consent of the parish priest.

The COM should submit an annual report to the parish priest detailing the use of the facility and the income and costs arising from its use by the club or external organisation. The report may be extracted from the parish's regular accounting package via specific account numbers identified with facility use or activities.

Where the parish conducts activities directly (e.g. tennis or other organised sporting, cultural or social events), the COM may choose to establish a separate CDF account for the purposes of holding related monies on behalf of the parish. Where a separate club or organisation uses the parish facility, it is recommended that the income and expenditure be transacted through the main Church Account. All specific-purpose accounts, such as a parish facility COM account, must be included in the parish’s consolidated financial reports.

Right to use agreement

Where the facility is provided to a separately constituted club (whether incorporated or not), it is recommended the COM ensure that a Memorandum of understanding—hosted club or facilities on parish land agreement (document link to come) is created to manage the relationship between the parish and the club or other hosted entity.

Outside-school-hours childcare on church property

Background

General principles have been prepared to assist parishes when granting licences over parish land to service providers for the provision of outside-school-hours childcare (OSHC) services.

Refer to the Outside school hours child care on Church property guidelines (document link to come).

The OSHC service provider must at all times operate as an independent contractor, and must not hold itself out as being associated with the Church, the parish or the parish school. A parish should not operate an OSHC service in its own right.

Parishes must refer to the Archdiocese for further advice if they currently operate an OSHC service directly. Note that OSHC activities must be reflected in the consolidated financial accounts and reporting of the parish.